2025 Tax Brackets Deductions

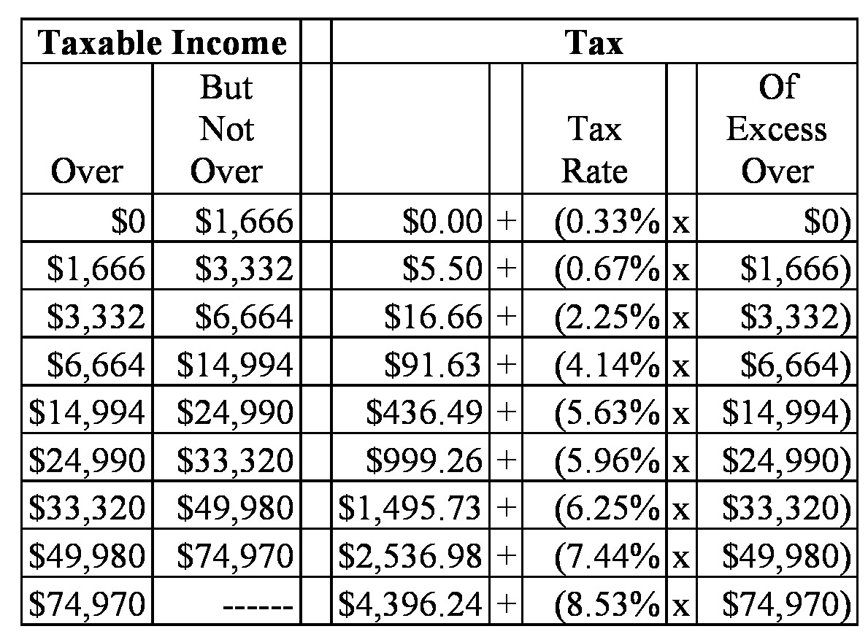

2025 Tax Brackets Deductions. The tax year 2025 adjustments described below generally apply to income tax returns filed in 2025. The 2025 tax year features seven federal tax bracket percentages:

But you can reduce your taxable income — the amount of income you can be taxed on — by claiming certain tax deductions. Tax deductions can lower the amount of income that is subject to tax.

2025 Tax Brackets Mfj Limits Brook Collete, But you can reduce your taxable income — the amount of income you can be taxed on — by claiming certain tax deductions. So how do the tax brackets and deductions work?

Tax Brackets 2025 Irs Single Elana Harmony, For the 2025 and 2025 tax. The 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2025 tax year.

Federal Tax Brackets 2025 Single Mela Stormi, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Heads of households will see their standard deduction jump to $21,900 in.

2025 Tax Chart Irs Wilow Kaitlynn, But you can reduce your taxable income — the amount of income you can be taxed on — by claiming certain tax deductions. The internal revenue service (irs) has released adjustments to tax brackets for 2025, adding thousands of dollars to most marginal tax brackets, and potentially.

Irs Tax Brackets 2025 Chart Printable Forms Free Online, While the actual percentages will remain the same, the income levels of each bracket change annually to adjust to. 2025 irs tax brackets, standard deductions.

Tax Filing 2025 Usa Latest News Update, For the 2025 and 2025 tax. There are seven (7) tax rates in 2025.

10+ 2025 California Tax Brackets References 2025 BGH, See current federal tax brackets and rates based on your income and filing status. Federal tax brackets will see a 5.4% rise from 2025, meaning that taxpayers whose salaries have not kept pace with inflation may be able to shield more of their.

2025 federal tax brackets bitenipod, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Single or married filing separately:

Federal Withholding Tax Tables Awesome Home, There are seven (7) tax rates in 2025. If you start now, you can make plans to reduce your 2025 tax bill.

Tax Brackets 2025 Dependents Veda Thekla, Heads of households will see their standard deduction jump to $21,900 in. Your bracket depends on your taxable income and filing status.